All Categories

Featured

State Farm agents market whatever from house owners to vehicle, life, and various other preferred insurance products. State Farm provides global, survivorship, and joint global life insurance policies - adjustable whole life insurance.

State Ranch life insurance coverage is generally conventional, using steady alternatives for the average American family members. If you're looking for the wealth-building chances of universal life, State Farm does not have competitive alternatives.

Yet it does not have a strong visibility in various other monetary products (like universal strategies that open up the door for wealth-building). Still, Nationwide life insurance plans are extremely obtainable to American households. The application procedure can also be more workable. It helps interested parties obtain their first step with a reputable life insurance coverage strategy without the far more difficult discussions concerning investments, financial indices, etc.

Nationwide loads the critical duty of obtaining hesitant purchasers in the door. Also if the worst takes place and you can not obtain a bigger strategy, having the defense of a Nationwide life insurance policy policy might change a purchaser's end-of-life experience. Read our Nationwide Life Insurance coverage testimonial. Insurance policy firms use medical examinations to determine your risk class when using for life insurance.

Buyers have the choice to transform prices monthly based upon life conditions. Certainly, MassMutual supplies amazing and possibly fast-growing opportunities. These plans often tend to perform best in the lengthy run when early down payments are higher. A MassMutual life insurance policy agent or monetary consultant can aid buyers make strategies with space for modifications to satisfy short-term and long-term financial objectives.

Best Iul Policies

Some buyers might be amazed that it provides its life insurance policy policies to the general public. Still, armed forces members enjoy special benefits. Your USAA plan comes with a Life Occasion Option rider.

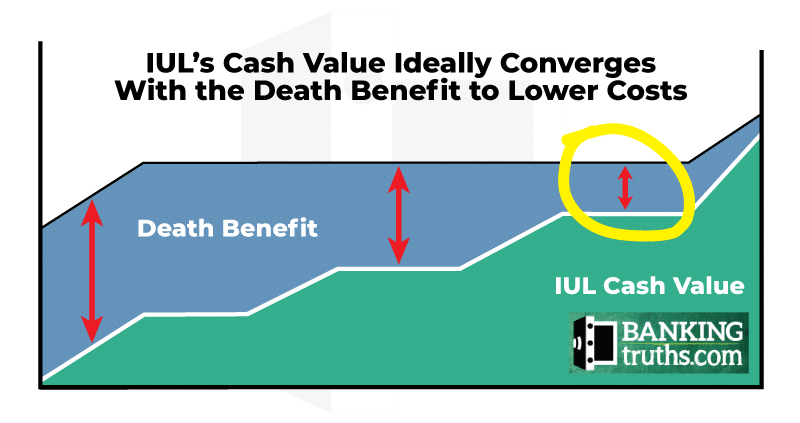

If your plan doesn't have a no-lapse warranty, you might even shed insurance coverage if your cash money value dips listed below a specific threshold. It may not be a great alternative for individuals who merely desire a death benefit.

There's a handful of metrics whereby you can judge an insurance coverage firm. The J.D. Power consumer fulfillment score is an excellent choice if you desire an idea of exactly how clients like their insurance plan. AM Finest's financial toughness score is one more important statistics to consider when picking an universal life insurance policy business.

This is specifically important, as your cash worth grows based upon the investment alternatives that an insurance coverage firm provides. You must see what financial investment options your insurance service provider deals and contrast it against the objectives you have for your policy. The very best method to find life insurance policy is to collect quotes from as several life insurance policy companies as you can to understand what you'll pay with each plan.

Latest Posts

What Is The Difference Between Term And Universal Life Insurance

What Is Fixed Universal Life Insurance

New York Life Universal Life